Navigating your way through your medical insurance plan can be one of the most complicated, scariest, and most confusing things you’ve done in a while—especially since it has everything to do with your health and wellbeing.

To help you reduce your Medicare costs (and fear of choosing the wrong plan), it’s wise to familiarize yourself with the different terms of Medicare. This can help reduce the risk of paying more for insurance when there is no need!

In this article, we’re going to give the 4-1-1 when it comes to different Medicare terms and what they mean.

Medicare Terms

Depending on your medical insurance provider, the terms and unique details of each term can change from provider to provider. However, we’re going to cover the most “basic” yet common terms when it comes to insurance and Medicare.

Our Medicare Glossary—most important terms:

- Coinsurance:

With the prefix “co”, meaning with or together, this term is referring to the percentage of the total cost (which will be fixed) that you pay when you purchase medication or pay for coverage. Normally, coinsurance would be around 25% of the drug’s retail price—for any Tier 3 brand-name medications.

- Co-payment:

Instead of the fixed percentage, with co-payment, you will pay a set amount for all drugs from within a tier. For example, every time you pick up your monthly medication, you’ll pay a set $10. If you’re purchasing more generic or brand-name drugs, this co-payment can be set lower.

The same goes for doctor appointments—you’ll be required to pay that fixed co-payment every time you visit certain doctors (depending on which and what the visit is about).

- Cost sharing:

This total cost is an all-inclusive term that can include co-payments, coinsurance, and/or deductibles (which we’ll get into next). This all-in cost for healthcare and prescriptions can vary depending on whether you’re in or out-of-network or which pharmacy you’re using.

- Deductible:

As mentioned previously, you’ll often hear this term when health insurance policies are being explained. If your plan has a deductible—you’ll have to double-check to see—this can dictate how much you’re going to end up paying for healthcare services and for each prescription.

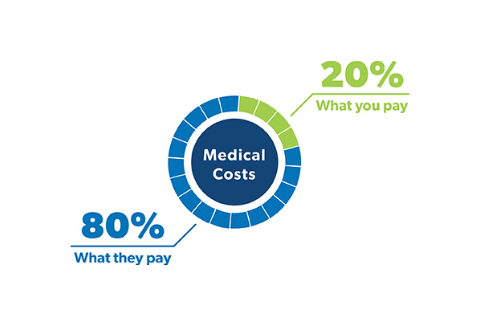

The deductible is the limit of the amount you pay toward healthcare or drugs before the plan takes over coverage. However, the amount of coverage will differ.

Before the deductible is hit, you might be paying full cost OR partial cost.

After the deductible is reached, the insurance will either cover the full cost of the service or drug or will only cover partial (share the cost through co-payment or coinsurance) on your prescription.

- Premium:

This is the price you or your employer are entitled to pay each month for insurance coverage.

____

Those are the five most important terms that you need to know when it comes to health insurance, since they often dictate directly how much you’re going to be paying out-of-pocket for certain services or products.

However, the glossary goes on and on.

Here are some other important terms you should familiarize yourself with:

- Allowed Amount/Allowable Charge/Maximum Allowable: This refers to the price that health insurance companies will set on a particular healthcare service, supplies or drug to be the reasonable/minimum charge on the market.

- Claim: Done by the member (you) or your healthcare provider, this is a request that asks for certain coverage for medical services.

- Dependent: If you’re paying for a primary member plan, in some cases, you can add one or more dependents, who are going to be your spouse or children that are also covered.

- Effective Date: Pretty self-explanatory, this is the date that the insurance company provides at which your coverage will begin.

- Exclusion or Limitation: This refers to a very specific condition, treatment, service or situation in which the insurance plan does not kick in.

- HMO: Known as the Health Maintenance Organization, this financial system looks at your geographic location before providing you with their comprehensive health care services.

- HSA: Known as your Health Savings Account, this can help you pay for your medical expenses with your personal savings account, giving you access to your pre-tax money.

- In-Network Provider: If a healthcare service, hospital or pharmacy is within your plan’s network, you’ll be paying less. (If they are not within this network, they are referred to as an “Out-of-Network Provider”).

- Medicaid: If you cannot afford Medicare or other plans, Medicaid is funded by the federal and state governments that help provides health benefits to low-income individuals and families.

- Out-of-pocket Maximum: This is the maximum amount of money you’ll be required to pay for a year with deductibles, coinsurance, and co-payments.

- Pre-existing Condition: This refers to a health issue that has been treated or diagnosed before purchasing a specific health insurance plan.

- Provider: Any place or professional who provides healthcare, like a doctor, hospital or dentist.

- Waiting Period: When it comes to an employer’s healthcare insurance, you as an employee may need to go through a waiting period where you will not have access to full coverage under the company’s health plan.

The world of insurance can be a confusing place—and so can the terms of any health insurance plan.

We hope that this article has provided you with sufficient information regarding the five most important terms we consider when it comes to Medicare. Familiarizing yourself with these words can always help you make a well-informed decision when it comes to choosing your next insurance plan.

If you’re in need of any more assistance in choosing the Medicare program that works for you or need guidance navigating through any other unfamiliar health insurance terms, please get in touch with Every Way Health at 877-460-3943 or the customer service team of your local insurance provider, who can help provide you with more helpful insight.